Beam x Mastercard: The Future of Payments is Here

- A Partnership Sealing the Gap for Thai SMEs

- Digital Payment Adoption Continues

- “Beam Bolt” Revolutionizes Payment Experience

- Why Cashless Payments Matter for Thai Businesses

- A Vision from Beam

- What’s Our Next Move?

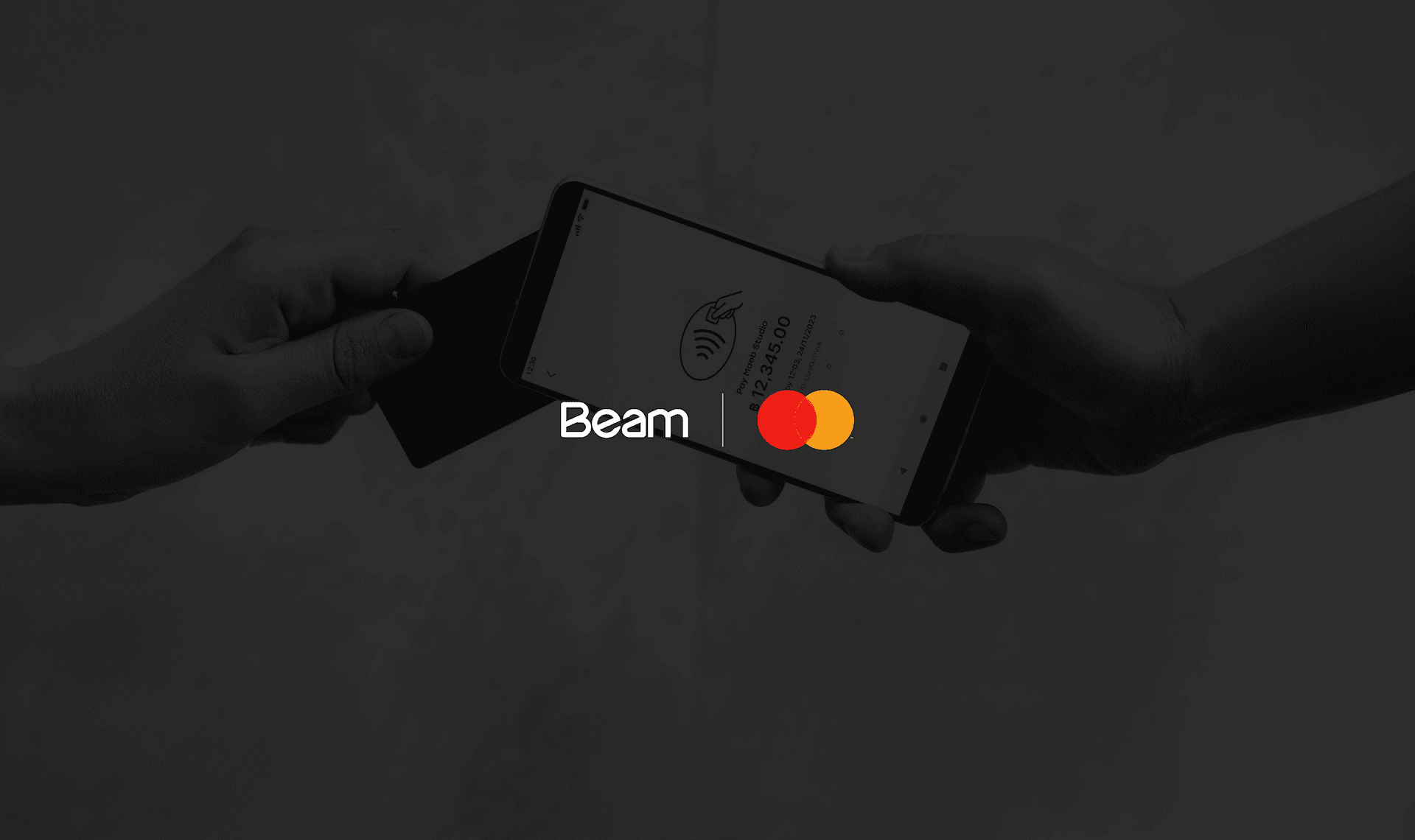

A Partnership Sealing the Gap for Thai SMEs

Beam has announced a key partnership with Mastercard, a global leader in digital payments. Through this collaboration, Beam is powered by Mastercard Cloud Commerce, Mastercard’s advanced technology. This partnership takes Thailand’s payment landscape to the next level, introducing tap-to-phone technology to all SMEs nationwide.

At present, Thai SMEs are a key driver of the economy, generating over one-third of the country’s GDP. Essentially, most SMEs still enormously rely on cash, as Electronic Data Capture (EDC) terminals can involve a considerable amount of cost and certain limitations. For instance, some models may not support all credit card providers, face the connectivity challenges, or the complex setup. All of these can inevitably cause lost sales opportunities for businesses. “Beam Bolt” was created to change that by empowering merchants to accept contactless card transactions directly on smartphones without the need for additional hardware.

Digital Payment Adoption Continues

Purchasing and accepting payments through QR PromptPay has become deeply ingrained in Thai daily life, from street vendors to major department stores. This rapid adoption reflects the country’s shift toward a cashless society, where consumers increasingly expect faster, simpler, and more convenient ways to pay. With this in mind, Beam, as an innovative payment provider, aims to enhance checkout experiences and help SMEs keep pace with evolving payment trends and shopper expectations.

“Beam Bolt” Revolutionizes Payment Experience

Building on the widespread adoption of QR payments, Beam Bolt eliminates the key obstacles for merchants by transforming any NFC-enabled smartphone into a payment acceptance device. The partnership between Beam and Mastercard marks a turning point in how Thai businesses can accept payment, providing promising opportunities for even local businesses to access the global-level security standards in payment transactions, entirely powered by Mastercard’s Cloud Commerce.

Why Cashless Payments Matter for Thai Businesses

Beam Bolt plays a pivotal role in connecting merchants and shoppers, making payment processing seamless while offering complete payment methods for domestic and international consumers. It’s now undeniable that the maturity rate of cashlessness has rapidly increased over the past decade in Thailand, so Beam Bolt provides a series of business advantages in this highly competitive environment.

To illustrate, transaction fees start as low as 1.8% for card payments, with the added option of installment plans with various leading banks. Merchants also have the flexibility to withdraw funds to any bank account, while popular e-wallets such as AliPay, WeChat Pay, TrueMoney, and LINE Pay are supported. This is especially valuable as more Chinese tourists return to Thailand, bringing higher demand for cross-border payment options. Onboarding requires only one to three business days, meaning even a small countryside café can quickly start accepting credit card payments from international customers, right from the palm of their hand.

Additionally, to further accelerate cashless adoption among Thai SMEs, Beam has launched a new campaign called the “Lightning Bolt Offer”. As part of this campaign, the first 20 merchants who complete at least 90 transactions within 90 days will receive a free smartphone. This initiative helps stimulate and empower businesses to adopt more digital transactions, whilst also encouraging more convenient financial management. Merchants can join the campaign via this link

A Vision from Beam

“The collaboration with Mastercard’s Cloud Commerce represents a huge step in our cashless movement, rooted in our mission to make the ‘World’s Simplest Way to Checkout’ a reality. We truly understand today's business challenges, that accepting all payment methods has often been nearly impossible. Hence, Beam Bolt comes into action to eliminate barriers and encourage merchants to accept payment directly on their phone” said Win Vareekasem, Co-Founder & CEO, Beam.

What’s Our Next Move?

All things considered, this partnership marks a major milestone in Beam’s mission to drive payments simpler and more accessible throughout Thailand and beyond. With Mastercard’s advanced technology and Beam’s innovative approach, merchants can now embrace a future of growth as we continue to thrive and lead the payment frontier to the next level. Elevating Thai SMEs to grow their businesses with confidence, while keeping pace with a world that’s moving steadily toward a cashless society.