Making Shopping in Thailand Easier with Installment Payments: Discover How

In the heart of Thailand’s bustling markets and dynamic online shopping scenes, there’s a transformative force at play: installment payment options. Installment payments are more than just making shopping smoother for shoppers; they're carving out new pathways for business growth and customer engagement. When you integrate installment payments into your business, you're not merely selling products; you're opening up a world of possibilities for your shoppers and setting the stage for substantial growth in your business.

- Why Installment Plans?

- Getting Started: A Merchant’s Checklist

- Empowering Your Business with Smart Payment Solutions

- Key Takeaway

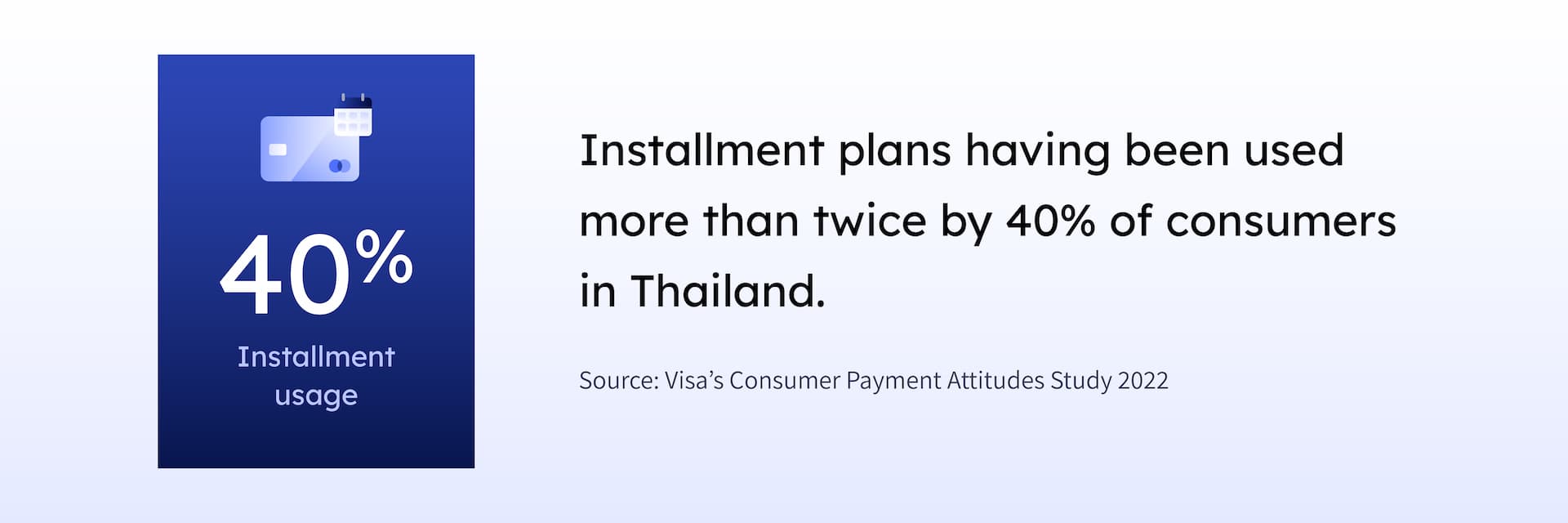

Let's dive into why installment payments are becoming a merchant's best friend and how they can propel your business forward. Here's the scoop: over 40% of Thai shoppers with credit cards are leaning into installment plans, not just once, but repeatedly. This trend isn't slowing down; it's gaining momentum, offering an opportunity for merchants ready to adapt.

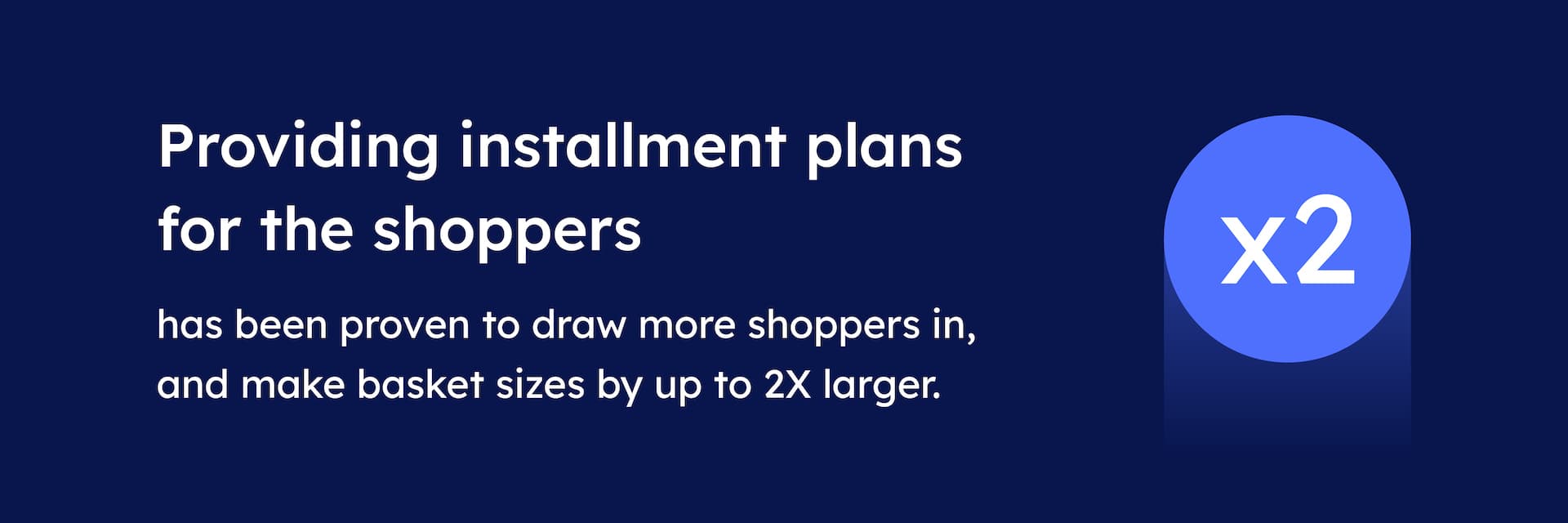

Why Installment Plans?

Imagine breaking down the barrier that often stops shoppers in their tracks: the price tag. By offering installment payments, you're not just selling products; you're selling possibilities. This approach has been shown to draw in crowds, making those bigger purchases seem less daunting and, crucially, boosting basket sizes to double their usual volume. For any merchant, that’s music to the ears.

Getting Started: A Merchant’s Checklist

Starting with installment payments may seem overwhelming, but it's simpler than you think. Here are a few things on how to choose a payment platform that aligns with your business goals:

Fast bank connections:

Choose a platform that streamlines the bank connection process, making it possible to integrate with major banks quickly, rather than waiting for months and years. Your time is valuable; don't spend it waiting on slow setups.

Demand transparency:

Opt for a platform offering clear, upfront pricing. Hidden fees can undercut your profits and sour your experience. Knowing your costs upfront is essential for financial planning and peace of mind.

Customizable Customer Incentives:

Look for platforms that allow you to set flexible terms. Tailoring installment thresholds can motivate higher purchases, turning browsers into buyers and occasional shoppers into regulars—for instance, a special 10-month installment plan for a sofa over 20k Baht, making it easier for customers to commit to a purchase.

Security and compliance:

Ensure your chosen platform is not just any platform, but one that’s fully licensed, PCI DSS level 1 certified, and compliant with the Bank of Thailand’s regulations. The security of your transactions and your customers' information is non-negotiable in the digital age.

Empowering Your Business with Smart Payment Solutions

Beam stands at the forefront of payment solutions, dedicated to enhancing merchant and shopper experience. We're here to provide an array of payment options tailored to the unique needs of your business. With Beam, integrating installment payments can be a seamless and profitable venture.

Key Takeaway

Embrace growth with installment payments: Over 40% of Thai shoppers repeatedly choose installment plans, doubling their purchase sizes and unlocking new growth avenues for merchants.

Merchant’s checklist for success: Prioritize platforms offering fast bank connections, transparent pricing, customizable customer incentives, and robust security and compliance standards to integrate installment payments into your business seamlessly.

Tailored payment solutions: With Beam, you get access to a suite of payment solutions designed to meet your business's unique needs, facilitating an effortless integration of installment payments for enhanced satisfaction and sales growth.

Ready to make a change that could redefine your success? Beam is here to guide you every step of the way.

Source: Visa’s Consumer Payment Attitudes Study 2022