The Cashless Movement: A tap today, a cashless tomorrow

- The world used to be cashless.

- And is en route, back to being cashless.

- Cash is expensive.

- Where we would love to be, a mere pledge, a target.

- The goods that give.

- It takes a hand, from everyone.

- Conclusion.

The world used to be cashless.

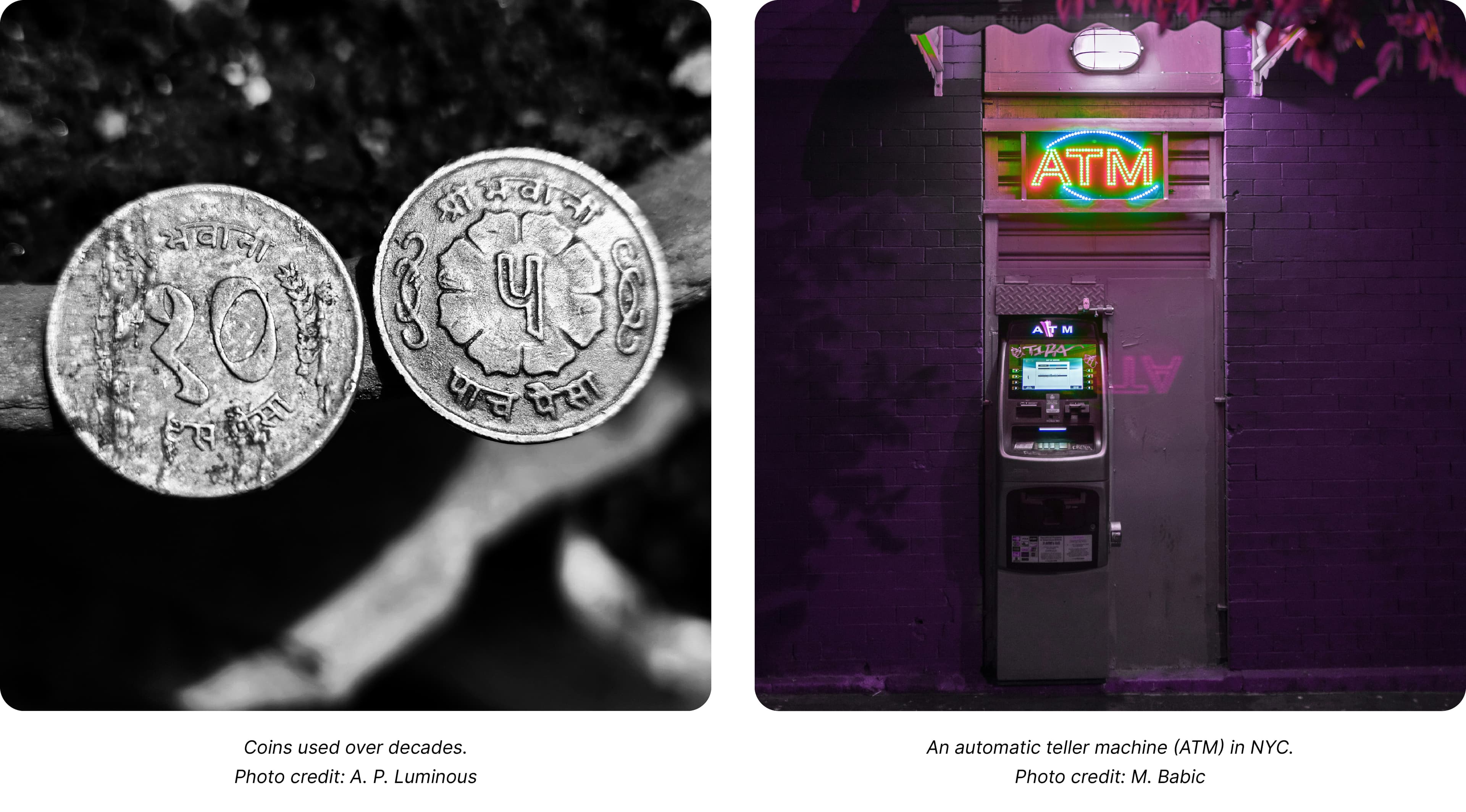

Before the first coins were invented around 650 BC, we were trading through a bartering system with shells, commodities, or simply swapping goods and services. Cash was first introduced after precious metals such as gold and copper were minted into coins, and adopted (literally, “coined”) as the standard medium of exchange. It had a trusted value with common acceptability, it was durable and was 10X more convenient - versus carrying one’s farm’s produce i.e. a sack of oranges to go shopping. Upon growth of trade, the minting and carrying of coins gradually became a burden, and we continued the strive to make payments frictionless through the invention of credit notes or cheques that could be redeemed for coins, and then eventually bank notes.

The usage of cash, a phenomenon with profound lasting effects for the next nearly 3,000 years would occur - as we are witnessing today, cash has expanded economies, enabled banking systems, accounting, taxation and the acceleration of the progression of humanity.

And is en route, back to being cashless.

Today, most of us reading this article have likely (replaced your piggy banks & safes, and) adopted digital means of cash in the form of either cards, or banking and e-wallet apps for savings and payments. A new age has been on the rise, driven by technological advancements, progressive regulations and initiatives, a behavioral transition becomes inevitable as we yearn for a frictionless world. One as neat as stepping off an Uber or Grab, and not noticing that a payment has just been made.

This disruptive shift is far from uniform, it typically starts in retail and in major city centres, and trickles down to other verticals and peripheries. Fast in some, slow in most. Today, less than 1/3 of payments across the world is digital (estimated 45% for Thailand), with the remainder through cash.

Cash is expensive.

There is a significant ‘cost’ to manage cash for everyone, to name a few:

Businesses - managing cash change, miscounts, and lost trails for reconciliation (fun fact: on average it costs stores 1.5% of sales to accept cash as an option, excluding loots and miscounts)

Consumers - burden of carrying a cash wallet, and exchanging it for foreign currencies abroad

Banks - deploying ATMs, distributing, collecting and delivering cash

Central banks - minting bank notes and coins (fun fact: many coins in the past century was worth more in its raw metal form than its face value promissory form, although many discontinued today it used to include the US$1 coin), managing cash circulation, shortfall of taxation, and cash movement surveillance

Beyond this, societal and environmental costs: around security with crimes in robbery, counterfeit bank notes, hygiene-related issues, and environmental factors.

It is noteworthy that while these costs of cash exist, cash has its benefits that should be valued for too. Cash offers accessibility, inclusivity, privacy and support of informal economies. Even more so, in times of emergencies cash is arguably the most dependable means of payment.

Where we would love to be, a mere pledge, a target.

We are starting a movement — The Cashless Movement, a global movement to work towards a primarily cashless society.

A first in Thailand, we believe Thailand can achieve a 90% cashless society by 2030. That means 90% of payment transactions in Thailand happen through digital means of payments.

Collectively, in Thailand we have already made incredible progress in becoming the nation with the highest adoption of mobile banking users (over 97% of internet users according to Visa) and have the right foundations to build on and achieve this target. At the end of the spectrum currently, Sweden, has 98% card adoption and a similar figure for the share of digital transactions being processed - world’s highest today.

This conforms and allows further progress with Thailand’s public plans and initiatives, as well as financial institutions and payment providers.

The goods that give.

Cashless societies are reaping benefits across the board. 90%+ of transactions being digital means less cash management issues and expenses such as:

1/2 the number of cash tills and registers nationwide

80% less ATMs (to <20 per 100,000 population)

100,000 more trees

1/3 less cash-related crimes

Thailand can save US$ 1.5B in ‘economic waste’ and have 5X less physical cash in circulation, to less than 3%, from 15% of GDP today.

Moreover, payments as fast as a tap or a scan would lead to over 50% faster checkouts. An economic growth booster, smaller wallets but bigger wealth for all.

It takes a hand, from everyone.

Consumers - wallet and banking apps. Becoming banked, then becoming e-banked, then going lighter on the physical wallet and effectively adopting digital payment solutions for day-to-day transactions.

Businesses - payment acceptance solutions. One of the largest gaps today revolves around the supply and adoption of solutions that have the payment methods that allow for a true cashless experience for all.

Government - supporting the movement. From the fundamental enablers of minimizing power outages, to internet access, to improving digital literacy, to modern financial literacy and inclusion, and to central bank digital currencies and infrastructure

Fintechs - providing all of the above. Continuous invention, iteration and improvement. All in the safe, yet fast and efficient manner.

Conclusion.

The world went from cashless, to cash, and now? The Cashless Movement, a global movement towards cashless. And in Thailand, we are targeting 90%+ digital transactions by 2030. Going primarily cashless will render our wallets obsolete, grow store revenues, boost the economy – and present safer, cleaner and sustainable communities. Nevertheless, we need a hand from everyone to make this a reality for the greater good.

Credits: Bank of Thailand, Visa, Google-Temasek-Bain & Company e-Conomy SEA 2024 report, Wikipedia, Beam analysis